by Alterna Mortgage | May 1, 2024 | Uncategorized

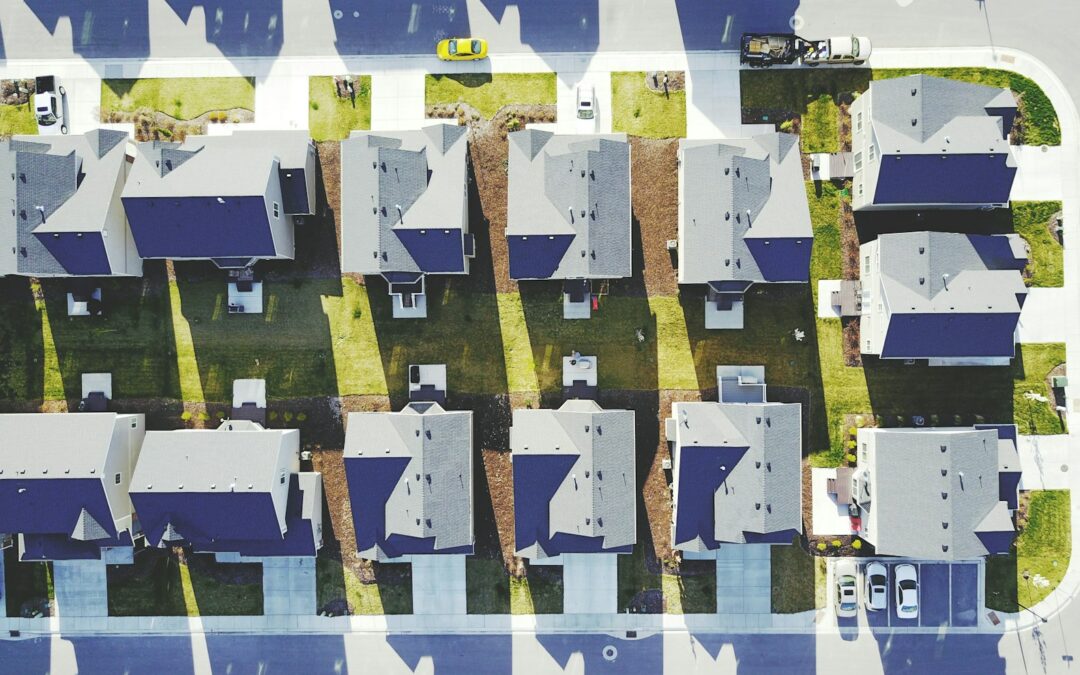

The notion of falling mortgage applications should likely spark the same question for many hopeful homebuyers: Will this push home prices down? Well, probably not. Mortgage applications overall have been down for much of the past year with interest rates as high as...

by Alterna Mortgage | Jun 7, 2022 | Home Buying, Housing Market, Interest rates, Real Estate, Uncategorized

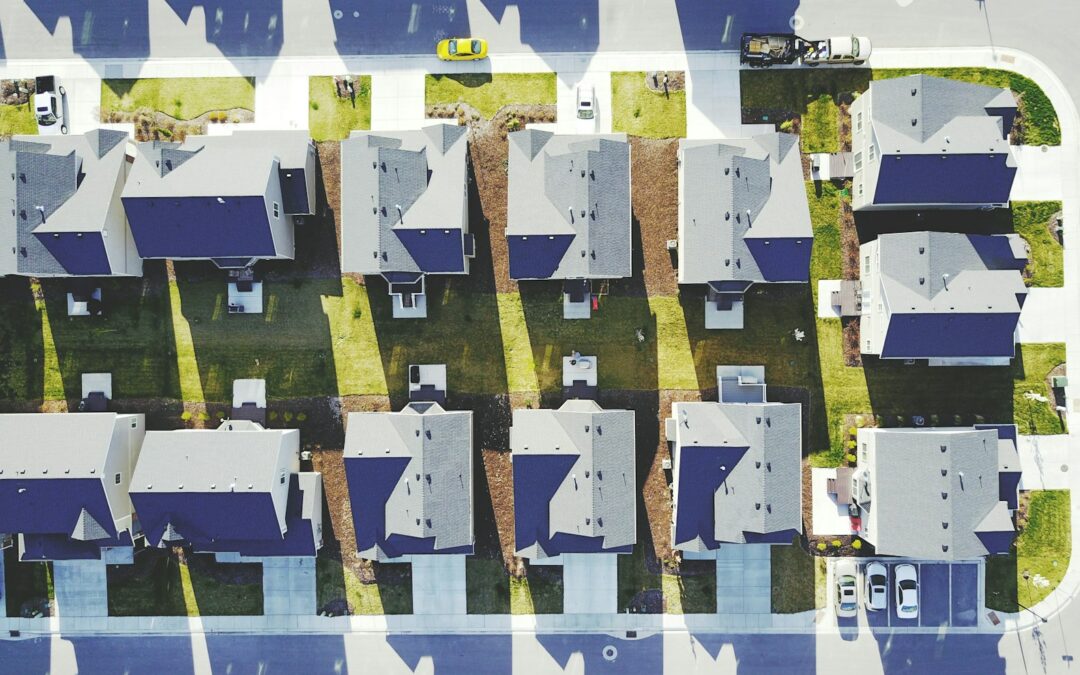

Despite the rise in home prices and rates, and in some cases a lack of inventory, it can still a good time to buy a home. Case in point: if you’re already ready to buy a home, you could lock in a favorable interest rate before things shift. Rates seem high at 5+%, but...

by Alterna Mortgage | May 17, 2022 | Financing, Housing Market, Interest rates, Real Estate, Refinancing, Uncategorized

The Fed may be over cooking the rate hikes. The result might lower the long-term rates. One week after the first .50% rate hike in 22 years, there were many Fed officials out using soothing rhetoric in an attempt to reassure financial markets they will be able to...

by Alterna Mortgage | Mar 31, 2022 | Uncategorized

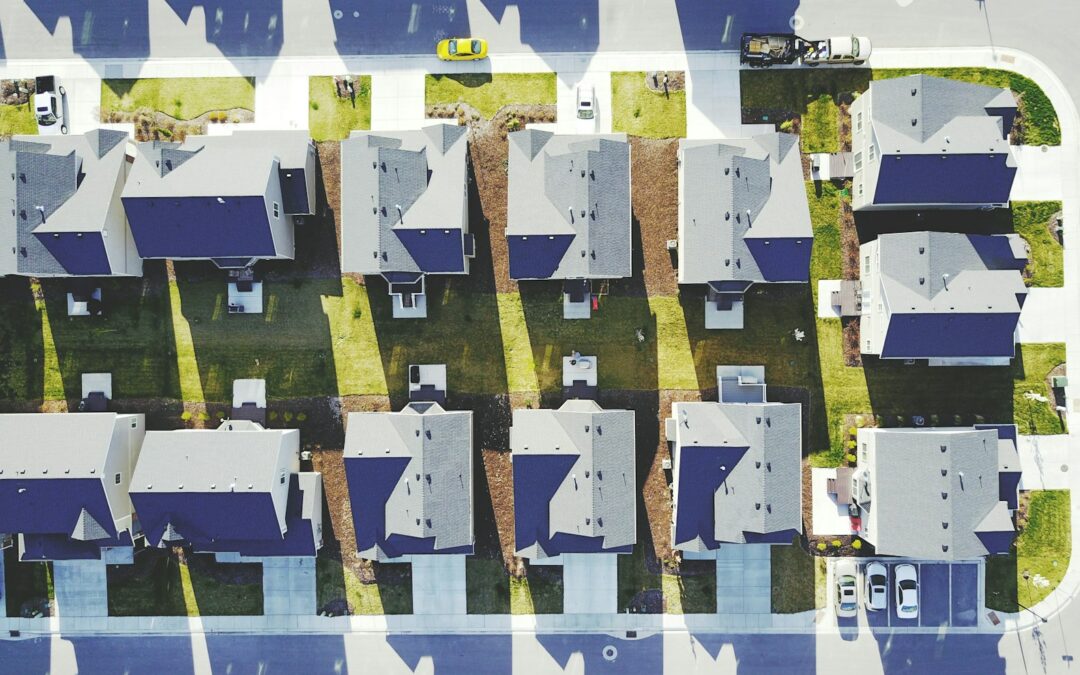

US home prices keep on climbing and now some are saying they have seen signs of a housing bubble on the way. While it it too early to tell exactly what will happen, what we do know is that a lot was learned from the last housing crash. If these concerning trends...

by Alterna Mortgage | Jan 30, 2022 | Financing, Home Buying, Inflation, Interest rates, Refinancing, Uncategorized

The Federal Reserve on Wednesday provided the clearest hint yet that it could start raising interest rates as soon as March A .25% increase is expected. The market experts were predicting 3 rate hikes. Now they are predicting 4 hikes. This will be the beginning to the...

by Alterna Mortgage | Nov 27, 2021 | Uncategorized

Sometimes it is easier to understand refinancing or home purchasing numbers when we can visualize them. Alterna Mortgage has a few interactive visual charts on our website to make the overall picture of recent (and historical) rates more clear: 30 Year Rate Chart...

Recent Comments