by Alterna Mortgage | Apr 21, 2023 | Financing, Home Buying, Housing Market

Spring is a popular season for house hunting as the weather gets warmer and the housing market picks up. Here are some tips to help you with your spring house hunting: Start early: Spring is a busy time for the housing market, so it’s best to start your search early....

by Alterna Mortgage | Apr 14, 2023 | Financing, Home Buying, Housing Market, Interest rates, Real Estate

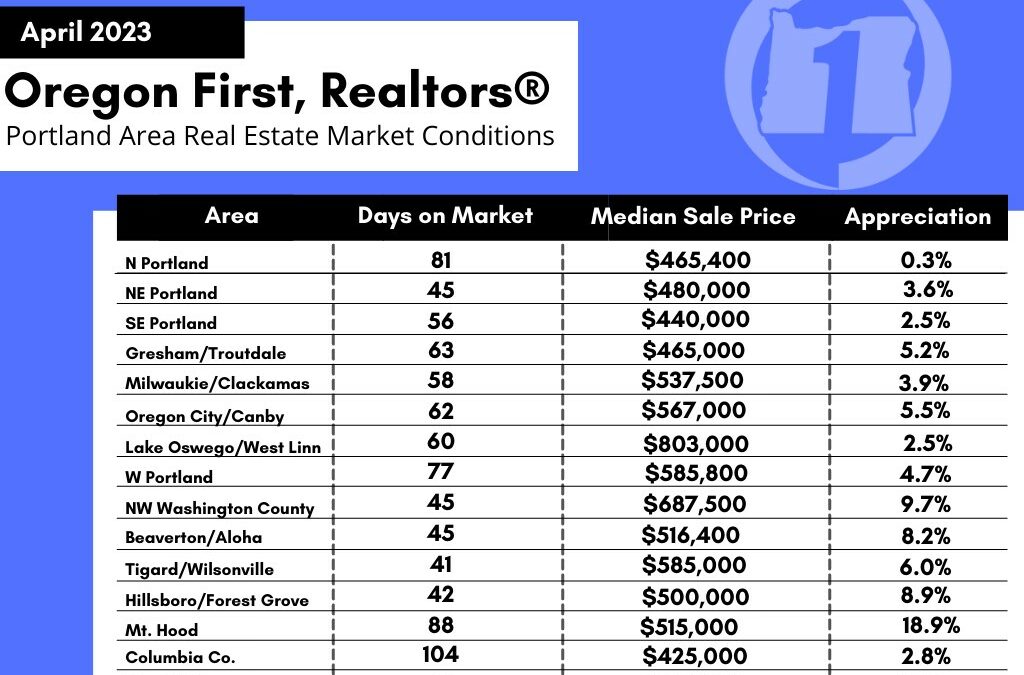

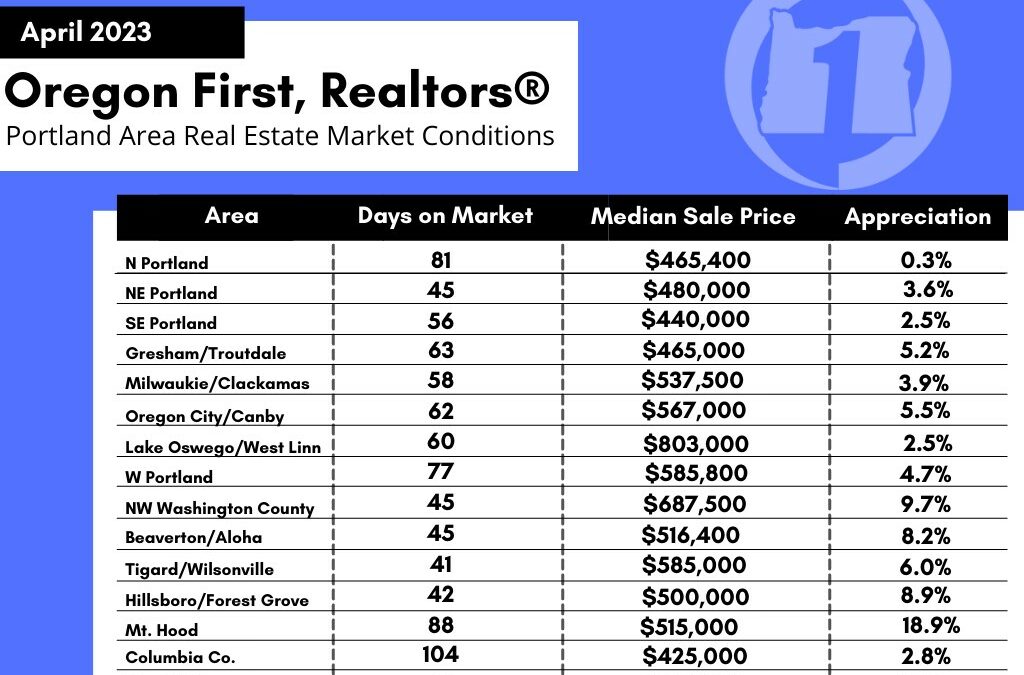

Home buying right now is completely different to what it was the last couple of years. We are not really seeing major price drops as much as we are seeing less appreciation and homes are on the market longer. The higher interest rates are sidelining a lot of buyers....

by Alterna Mortgage | Apr 10, 2023 | Home Buying, Housing Market

Buying a home for the first time can be both an exciting and daunting experience. Here are some tips to help you navigate the process: Determine your budget: Before you start looking at homes, figure out how much you can afford. Consider your income, expenses, and...

by Alterna Mortgage | Mar 26, 2023 | Financing, Home Buying, Interest rates, Real Estate, Refinancing

The Federal Reserve suggested that the days of regular increases in the federal funds rate could be winding down. The decision to increase federal funds rate by only 25 basis points on March 22, 2023, represents the first major test of its commitment to curtail...

by Alterna Mortgage | Mar 13, 2023 | Financing, Interest rates, Mortgage Programs, Refinancing

Today the national average 30-year fixed mortgage rate for the beginning of March 2023 is at 7.02%. This is the rate for big banks and large banking firms. Since Alterna Mortgage is an independent broker our average rate today for a 30-year fixed is 5.99%. That is a...

Recent Comments