by Alterna Mortgage | May 22, 2024 | Home Buying, Interest rates, Mortgage Programs, Real Estate

Down payment assistance programs continue to be a valuable resource for homebuyers across the country. The 0% Down Purchase program for qualified borrowers to receive a 3% down payment assistance loan, up to $15,000. Here’s how it works: First lien mortgage...

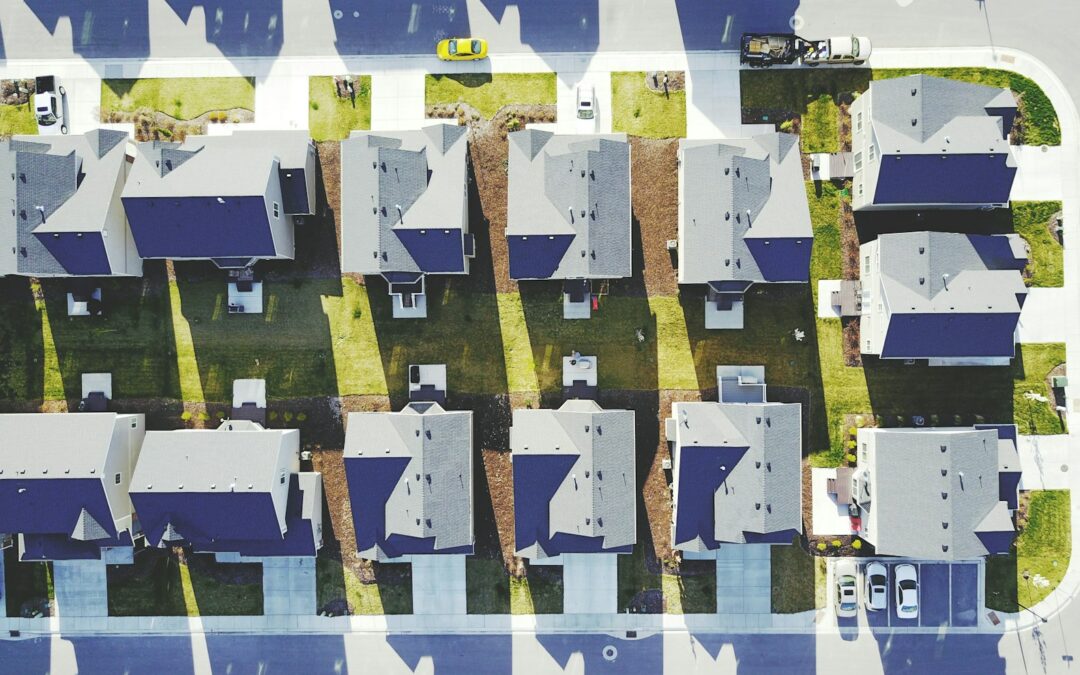

by Alterna Mortgage | May 12, 2024 | Financing, Home Buying, Real Estate

With home prices so high, you may be wondering what salary you’d need to earn to afford a home costing $500,000. This question can be difficult to answer, but with a few simple calculations, you can get an estimate of how much you need to make to purchase a home...

by Alterna Mortgage | May 4, 2024 | Financing, Home Buying, Inflation, Interest rates

The Fed still thinks that its next move will be a rate cut, and Powell clearly said that further rate increases are “unlikely.” Still, it is not clear how much the Fed will manage to cut rates this year. Inflation is cooling more slowly than officials had...

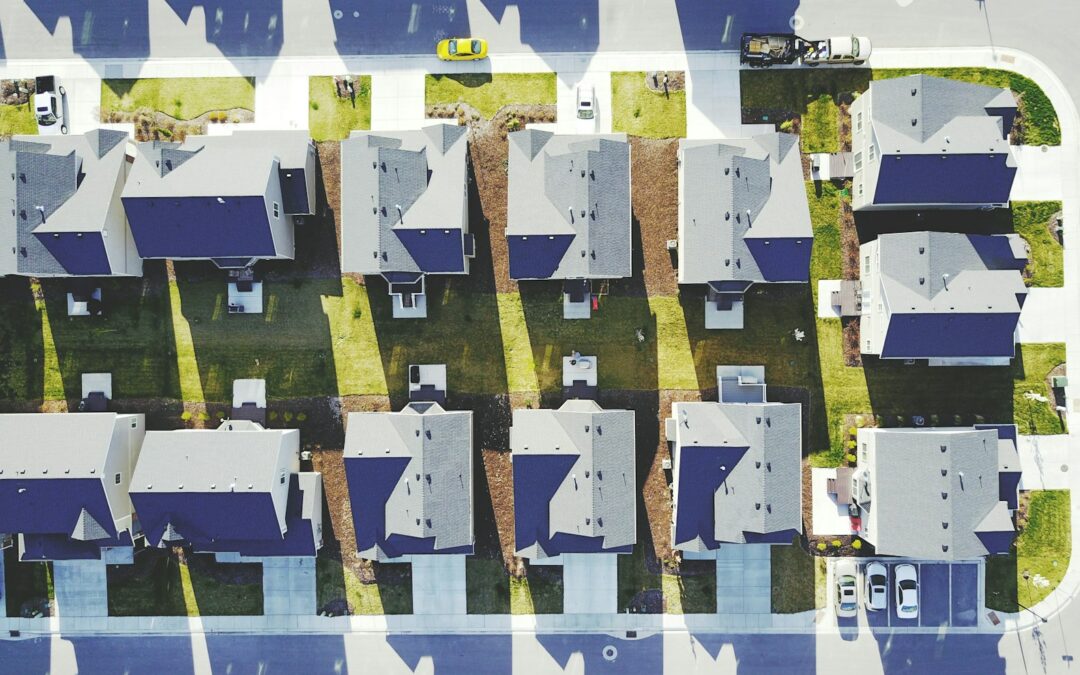

by Alterna Mortgage | May 1, 2024 | Uncategorized

The notion of falling mortgage applications should likely spark the same question for many hopeful homebuyers: Will this push home prices down? Well, probably not. Mortgage applications overall have been down for much of the past year with interest rates as high as...

by Alterna Mortgage | Apr 10, 2024 | Financing, Home Buying, Interest rates

Over the past couple of years mortgage rates have risen to the highest rates in 20 years. In March 2024 the current 30-year fixed rate mortgage rate is 6.88% which is more than double what rates were during most of 2020 and 2021. However, when looking at mortgage...

Recent Comments